The Trends and Challenges Driving EMEA Data Center Growth

The past year has been a turbulent one – with a major international conflict occurring in Eastern Europe and the entire globe slowly emerging from the COVID-19 pandemic. These large global events created significant economic and political changes and challenges, many of which had a meaningful impact on industries like travel, IT, transportation and data centers.

To learn more about how these global events have impacted the growth and demand for data center capacity and to explore how the European data center market is growing and evolving, we recently sat down with experts from the cloud and data center-focused analyst firm, Structure Research. These experts included Phil Shih, the firm’s founder and managing director, and senior analysts Sacha Kavanagh and Ainsley Woods.

During our discussion, we asked about the specific markets that are growing in the European region, the ways in which large global trends and issues are impacting that growth and how limited resources – such as land, power and skilled labor – are affecting the data center industry across the region.

Data Centers Today (DCT): Looking back at 12-18 months, what did EMEA data center growth and demand look like?

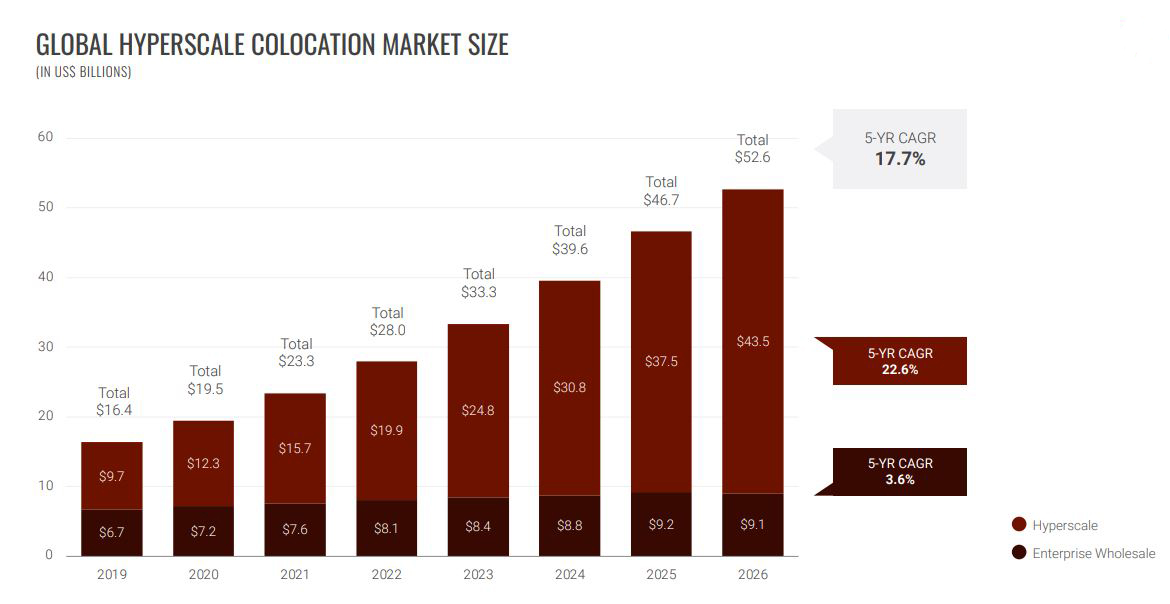

Phil Shih: In 2022, data center demand across all categories – hyperscale, wholesale and retail – was steady and healthy. But there was a little bit of a drop-off in certain segments and certain geographies. For example, we saw demand drop off in places like China, which had a very different approach to handling the ongoing COVID pandemic, which may have contributed to that. But that’s a very extreme example.

In the rest of the more developed countries across North America, Western Europe and the Asia-Pacific regions, demand stayed on a similar trajectory. However, there were bumps in the road early in the year with the outbreak of war in Europe, which affected energy prices and other underlying costs.

We saw a macroeconomic shift as a result of those events and that impacted enterprise decision-making. That contributed to a slight downward shift in the trajectory for the hyperscale cloud category since organizations decided to either dial down, optimize or delay projects.

Despite that, I would still describe [data center demand and growth] as steady, healthy, but somewhat slowing. I understand that sounds contradictory, but that’s the demand profile that has persisted throughout the year. But I anticipate that particular demand profile will persist throughout 2023.

That being said, despite an apparent drop-off in some markets, we’re still anticipating more than 20 percent year-over-year growth. But this was an industry with a growth rate of more than 30 percent year-over-year not long ago. Yet the public cloud is still a $100 billion industry that will continue to grow and create demand in the data center industry.

DCT: How did these trends play out in the European region?

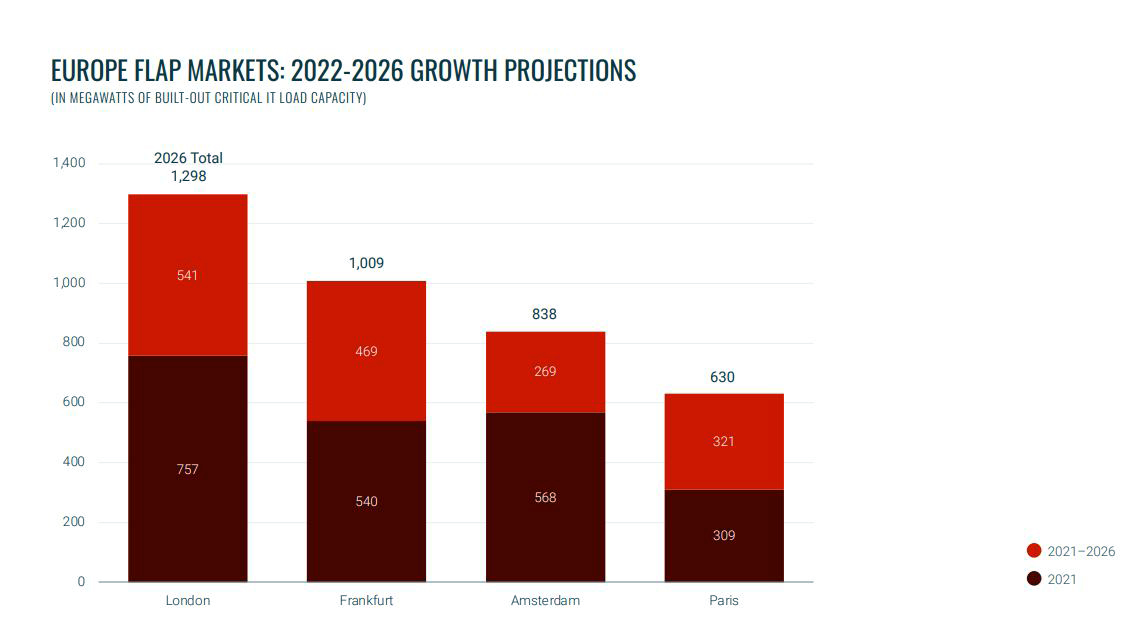

Sacha Kavanagh: It’s difficult to generalize because every market in the European region is different and impacted by different market forces, government regulations and other factors.

Sacha Kavanagh: It’s difficult to generalize because every market in the European region is different and impacted by different market forces, government regulations and other factors.

We’re seeing robust growth in Frankfurt and London. However, [growth in] Paris has been slightly more muted than those markets. In markets like Amsterdam and Dublin, we’ve seen a real slowdown over the past couple of years because of [data center construction] moratoriums that have been put in place because of power issues. In those markets, the local municipalities want to limit the spread of data centers for various reasons, one of which is the perceived high energy consumption.

But then we can look to the likes of Madrid. This is a very immature data center market compared to the others, but it’s growing at an absolutely phenomenal rate. That growth in Madrid was driven by construction projects spearheaded by cloud providers that were all announced around the same time. Much of those projects were spurred by new subsea cables that are improving connectivity to the region.

There are also some other really interesting markets bubbling up that have potential. Athens is a particularly interesting one. There was virtually no data center activity there for years, and then Microsoft announced a cloud region. However, it’s still yet to be determined how quickly and by how much the local colocation market will grow.

DCT: One of the largest stories of 2022 had to be the war in Ukraine. Has this conflict impacted EMEA data center demand, and if so, how?

Sacha Kavanagh: I don’t see the war having any significant impact on data center demand except potentially in Russia because of international operators having to suspend operations and exit the country. If there has been an impact, it has been a result of the massive spike in energy prices that we’ve seen across Europe.

Interestingly enough, this hike in energy prices could, in fact, spur further development. One of the reasons we think Madrid has so much potential is because that market has access to low-cost renewable energy, which is a great alternative as the rest of Europe tries to reduce its reliance on gas from Russia.

That being said, Germany has had the highest power costs in Europe for years, which hasn’t decreased demand for [data center space in] Frankfurt. And the even greater power prices we’re seeing today haven’t seemed to have an impact on demand there either.

Phil Shih: I think that a conflict like this just creates more variables in the entire decision-making process for hyperscalers and the colocation industry. It might not necessarily be apparent in terms of the market on a day-to-day, month-to-month basis, obviously, since demand is still there.

But you know that operators and public cloud platforms are factoring in what’s happening and perhaps looking for alternative scenarios based on what they feel might happen. They’re making decisions based on what they think might happen with pricing. They’re making decisions with the consideration of what would happen if the conflict spilled over or impacted the stability of other neighboring geographies. For example, a company like AWS might be a little more reluctant to expand closer to that region.

If projections that this conflict will go on for a long time are correct, and I think it will in some ways, it will create a permanent set of new variables that factor into the calculus of where operators and their customers build data centers.

Sacha Kavanagh: Excellent point. And alongside what Phil just mentioned is the impact on other local geographies. When Russia first invaded, I was very curious about what impact – if any – that would have on the Warsaw data center market, which is obviously another market that’s seen a lot of activity.

Surprisingly, it doesn’t seem to have done anything that I’ve read or heard about. That leads me to think that the conflict hasn’t resulted in operators and their customers pulling back from Warsaw as a possible destination.

I also want to explain that Ukraine was never a big data center market. It wasn’t on anyone’s road map. The tension and geographic proximity to Russia were probably factors.

“That being said, despite an apparent drop-off in some markets, we’re still anticipating more than 20 percent year-over-year growth. But this was an industry with a growth rate of more than 30 percent year-over-year not long ago. Yet the public cloud is still a $100 billion industry that will continue to grow and create demand in the data center industry.”

– Phil Shih, Structure Research

DCT: What would you say are the largest challenges or roadblocks impacting EMEA data center growth and construction?

Phil Shih: I would say the biggest challenge is the limitation in land and power. Over time, the available space in major metro areas starts to get tapped out.

So, where do operators go when they can no longer build around a major metro area – a place where there are a lot of eyeballs and end users? This has given rise to overflow markets around the major metro areas. But, especially on the hyperscale side, we’ve also seen them looking to serve multiple markets from an in-between location.

I think that’s the biggest challenge, and we’re already starting to see that in markets around the world. We’re building more data centers and accumulating more data, but they’re not building any more land.

Sacha Kavanagh: Land and power are certainly constraints. But I’ll add one more, which is labor. More data centers are being built, and they’re being built bigger. But they need to be operated. And what we’re hearing quite a bit from companies is the lack of skilled labor in construction, facilities management and operation.

This is especially true in markets like Madrid, which is an immature data center market. There’s not a talent pool large enough to fill all of the data centers that are coming. And that’s potentially going to impact pricing if it pushes up wages.

Ainsley Woods: We’re seeing operators working together and with education providers to develop new courses and qualifications for the sector, and to encourage young people to join the industry.

Ainsley Woods: We’re seeing operators working together and with education providers to develop new courses and qualifications for the sector, and to encourage young people to join the industry.

DCT: What, if any, changes do you see in the next year related to customer demand and/or customer behaviors?

Phil Shih: Partnering is important, understanding where I am going to locate my infrastructure, how many other locations can I do it across, you know, whether that be regional or international, how can I connect my locations and how can I get to the public cloud if need be. So, stitching all that together is important.

Ainsley Woods: I would add operators may be a bit more conservative, and we may see less speculative builds with operators not as willing to enter new markets without an anchor tenant.

Sacha Kavanagh: In addition, hyperscalers in particular will have a demand for higher densities. Sustainability is also becoming really important, and it’s not just about being able to demonstrate that you’re offsetting your power consumption with renewables. There’s a wider focus around the types of cooling, water use, the entire lifecycle of the data center and more sustainable materials in the construction. It’s becoming increasingly important to customers, not just hyperscalers, but enterprises of all shapes and sizes.

If you’re looking for digital infrastructure in the region, explore Vantage’s ever-growing portfolio of data centers in EMEA today.